Changes in the construction entities of energy storage projects

Welcome to our dedicated page for Changes in the construction entities of energy storage projects! Here, we have carefully selected a range of videos and relevant information about Changes in the construction entities of energy storage projects, tailored to meet your interests and needs. Our services include high-quality Changes in the construction entities of energy storage projects-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

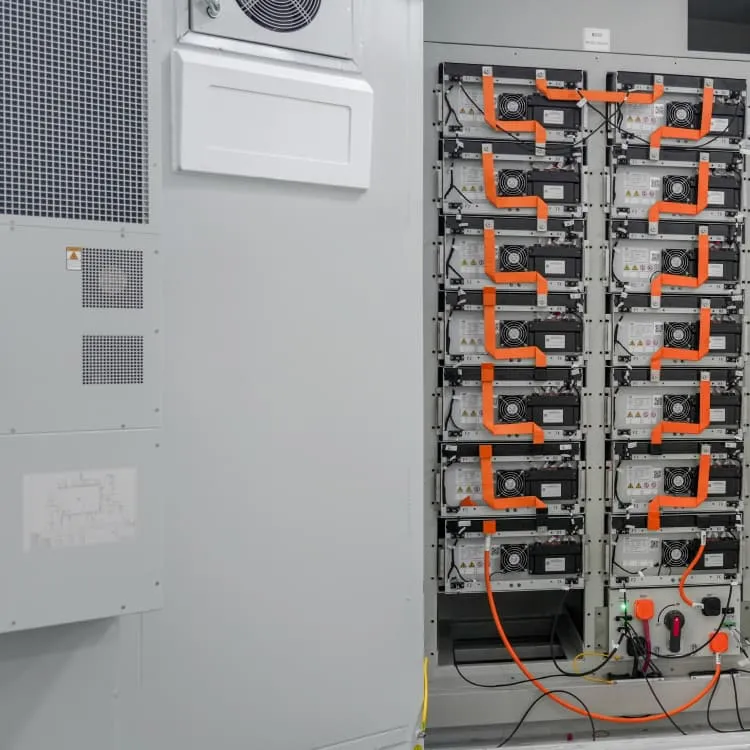

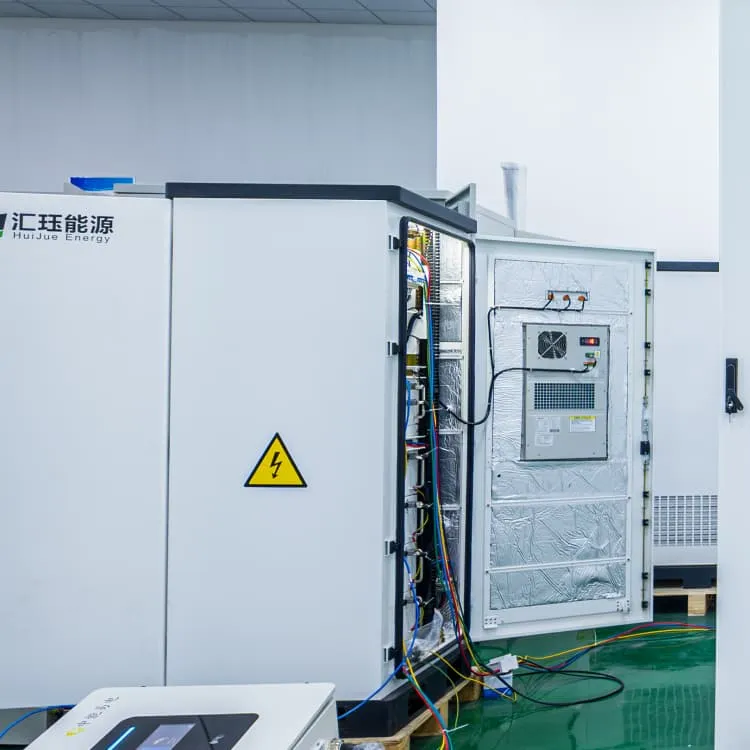

Wherever you are, we're here to provide you with reliable content and services related to Changes in the construction entities of energy storage projects, including cutting-edge energy storage cabinets, advanced lithium-ion batteries, and tailored energy storage solutions for a variety of industries. Whether you're looking for large-scale industrial storage systems or residential energy storage, we have a solution for every need. Explore and discover what we have to offer!

Clean Energy Tax Changes Cut Timelines, Add Red Tape | Balch

Stand-alone storage projects, or storage projects installed with a wind or solar facility, that begin construction by the end of 2033 will retain full eligibility for the Section 48E

Read more

X definition and meaning | Collins English Dictionary

X can be used to represent the name of a person when you do not know their real name, or when you are trying to keep their real name a secret.

Read more

FACT SHEET: Four Ways the Inflation Reduction Act s Tax

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind, solar, energy storage, and other

Read more

''One Big Beautiful Bill'' Act brings changes, clarity to energy

Energy storage escaped much of the pain inflicted on solar, but foreign entity restrictions may create some supply-chain challenges.

Read more

2025 Reconciliation Debate: Energy Provisions

Review key energy provisions in the House''s budget reconciliation bill, including proposals from multiple committees and potential impacts on energy policy, infrastructure, and

Read more

X on the App Store

X isn''t just another social media app, it''s the ultimate destination for staying well informed, sharing ideas, and building communities. With X, you''re always in the loop with relevant trending

Read more

X (Formerly Twitter)

X isn''t just another social media app, it''s the ultimate destination for staying well informed, sharing ideas, and building communities. With X, you''re always in the loop with

Read more

One Big Beautiful Bill Act Cuts the Power: | Frost Brown Todd

On July 4, 2025, President Trump signed H.R. 1—dubbed the One Big Beautiful Bill Act (OBBBA)—enacting significant modifications to clean‑energy credits

Read more

United States: New winds blowing as the sun sets on IRA tax

In brief The One Big Beautiful Bill Act (OBBBA) (" Act ") made substantial changes to credits created or enhanced under the Inflation Reduction Act (IRA). Modifications to these

Read more

A 2025 Update on Utility-Scale Energy Storage

While the energy storage market continues to rapidly expand, fueled by record-low battery costs and robust policy support, challenges still

Read more

Energy Storage Systems (ESS) Projects and Tenders

Search English हिन्दी भारत सरकार GOVERNMENT OF INDIA नवीन एवं नवीकरणीय ऊर्जा मंत्रालय MINISTRY OF NEW AND RENEWABLE ENERGY Home About Us

Read more

One Big Beautiful Bill New Law Disrupts Clean Energy Investment

To qualify, these projects must either be completed by the end of 2027 or begin construction within the next 12 months. This compressed timeline will likely force developers to

Read more

''One Big Beautiful Bill'' Act brings changes, some clarity to US

While the changes bring new issues to developers in the US, many market leaders agree that having more clarity on future projects is a welcome change from recent months.

Read more

What you need to know about the IRA and tax equity

Many direct pay transactions involving tax-exempt entities building solar and BESS projects that they will own are in the works, and more are expected as more such entities dip

Read more

''One Big Beautiful Bill'' Act brings changes, some clarity to US energy

While the changes bring new issues to developers in the US, many market leaders agree that having more clarity on future projects is a welcome change from recent months.

Read more

A 2025 Update on Utility-Scale Energy Storage Procurements

While the energy storage market continues to rapidly expand, fueled by record-low battery costs and robust policy support, challenges still loom on the horizon—tariffs, shifting

Read more

Final regulations on clean electricity production and

Introduction The U.S. Treasury Department and IRS on January 7, 2025, issued final regulations (T.D. 10024) related to the section 45Y clean electricity production credit and section 48E

Read more

House Reconciliation Bill Amends Clean

The effective date of the FEOC restrictions would vary depending on the specific FEOC restriction, as follows: (i)

Read more

X

X, or x, is the twenty-fourth letter of the Latin alphabet, used in the modern English alphabet, the alphabets of other western European languages and others worldwide.

Read more

Effects of the Final House Tax Bill on Projects

PTCs and ITCs on wind, solar and other renewable electricity and battery storage projects that are already in operation will not be affected by the House bill. Neither will tax

Read more

Battery Energy Storage Systems Report

This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Read more

One Big Beautiful Bill New Law Disrupts Clean Energy

To qualify, these projects must either be completed by the end of 2027 or begin construction within the next 12 months. This compressed

Read more

Download the X app

The X app for Android is available for Android phones and tablets. Download the Android app today to use X on your Android phone or tablet.

Read more

Navigating OBBBA: phaseouts, prohibited foreign entity rules,

In addition to the changes to the credit eligibility dates and the new foreign entity rules, the law makes a number of other policy changes. Below is a non-exhaustive list.

Read more

OBBBA: Navigating clean energy tax credits in a new era

Under this backdrop, in this article we explore the new provisions and significant amendments made by the OBBBA and highlight key takeaways for developers, energy

Read more

''One Big Beautiful Bill'' Act brings changes, clarity to energy storage

Energy storage escaped much of the pain inflicted on solar, but foreign entity restrictions may create some supply-chain challenges.

Read more

Incentives and credits tax provisions in "One Big Beautiful Bill

The Senate bill treats an entity as a foreign-influenced entity if the payments to the specified foreign entities are pursuant to an agreement that entitles the specified foreign entity

Read more

DOE Reduces Regulatory Hurdles For Energy Storage,

DOE is simplifying the environmental review process for certain energy storage systems such as battery systems, transmission line upgrades, and solar photovoltaic systems.

Read more

Tax-Exempt Entities and the Investment Tax Credit (§ 48 and

Tax-Exempt Entities and the Investment Tax Credit (§ 48 and § 48E) Tax-exempt and governmental entities, such as state and local governments, Tribes, religious organizations,

Read more

US restarts solar, storage permitting but agency gaps

The U.S. has resumed permitting of solar and storage on federal land but developers face a lack of agency staff and uncertainty over tax credits.

Read more

House Passes Major Cuts to IRA Clean Energy Tax

A listed Chinese battery and energy storage manufacturer (specifically, the entities listed in paragraphs (1) through (7) on page 47 of L.

Read moreFAQs 6

When will tax credits for wind and solar projects phase out?

Under the new law, tax credits for wind and solar projects phase out much sooner. To qualify, these projects must either be completed by the end of 2027 or begin construction within the next 12 months. This compressed timeline will likely force developers to accelerate their project schedules or risk losing critical tax credits.

Do new power plant and battery projects qualify for tax credits?

The final House bill would require new power plant and battery projects to check two boxes to claim "technology-neutral" tax credits under sections 45Y and 48E of the US tax code: the projects must be under construction for tax purposes within 60 days after President Trump signs the bill and they must then be placed in service by the end of 2028.

Which projects are tax deductible under the obbb?

Non-solar and wind technologies (e.g., storage, hydropower, and geothermal) fare much better under the OBBB. Tax credits for these projects are subject to a phase-down schedule that begins for projects that commence construction after 2033.

Can you get a section 45v credit from a wind or solar facility?

(The legislation clarifies that energy storage at a wind or solar facility is eligible for the ITC for that longer period.) Hydrogen facilities must begin construction before the end of 2027 to claim the section 45V credit. The new law does not change the definition of “beginning of construction.”

Do construction projects qualify for tax credits?

Tax credits for these projects are subject to a phase-down schedule that begins for projects that commence construction after 2033. Projects beginning construction in 2034 and 2035 will still qualify for tax credits but with a 75% and 50% haircut, respectively.

How does the obbb affect renewables and energy transition?

The OBBB’s enactment dramatically shifts the landscape for renewables and energy transition investments.

Related Contents

- Huawei s energy storage projects under construction in the Netherlands

- Global construction of large-scale energy storage projects

- Spanish energy storage construction projects

- Construction of large-scale energy storage projects in the UAE

- EU Energy Storage Projects 2025

- Overseas photovoltaic energy storage projects

- Engage in energy storage projects

- Energy Storage Project Construction Record