Input tax rate on solar panel sales

Welcome to our dedicated page for Input tax rate on solar panel sales! Here, we have carefully selected a range of videos and relevant information about Input tax rate on solar panel sales, tailored to meet your interests and needs. Our services include high-quality Input tax rate on solar panel sales-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

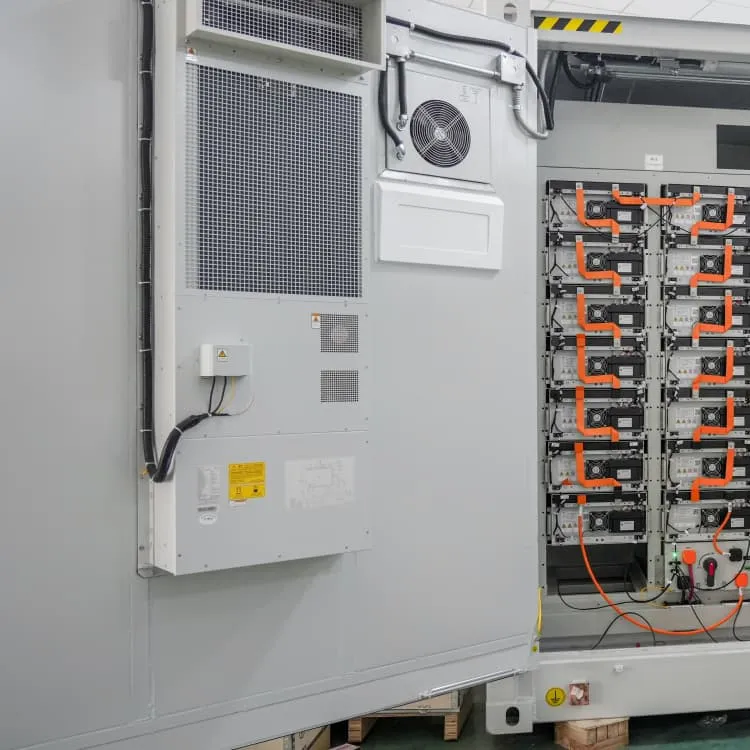

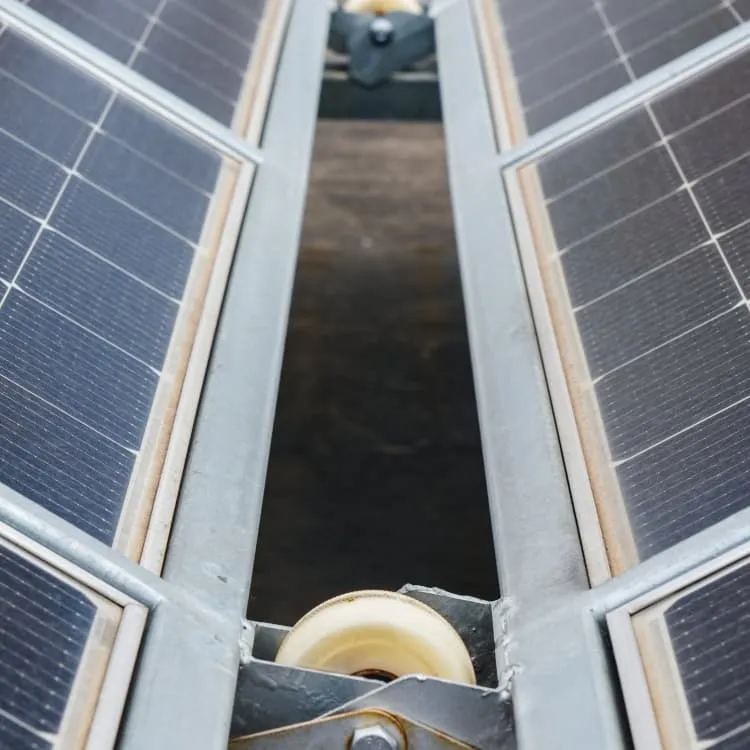

Wherever you are, we're here to provide you with reliable content and services related to Input tax rate on solar panel sales, including cutting-edge energy storage cabinets, advanced lithium-ion batteries, and tailored energy storage solutions for a variety of industries. Whether you're looking for large-scale industrial storage systems or residential energy storage, we have a solution for every need. Explore and discover what we have to offer!

Impact of GST on Solar & Renewable energy

Takeaway In conclusion, the GST has had a significant positive impact on the solar energy and renewable energy sectors. The reduction in

Read more

Are Solar Panels Exempt From Property Taxes and Sales Taxes in

Local tax incentives lessen the overall cost of installing solar panels. Here are the states that provide property tax and sales tax exemptions for solar panels.

Read more

GST on Solar

The tax rate for renewable energy devices and parts of solar power has been scheduled at 2.5 per cent of CGST. The GST rate for several renewable

Read more

Guide to Sales and Property Tax Exemptions for Solar

As of September 2024, 18 states have sales tax exemptions on buying, and the installation of, new residential and commercial solar power

Read more

Taxability on sale of solar panel and its installation services

A discussion forum explores GST taxation for solar panel sales across three scenarios: standalone product sales, separate invoices for products and installation, and

Read more

Maximize Solar Savings with State Solar Sales Tax Exemptions

When you purchase a solar energy system, you typically pay sales tax on the equipment, just like any other purchase. This sales tax can range from 2.9% to 9.5%,

Read more

What is the tax rate for solar panels?

In summary, tax rates for solar panels are influenced by various layers of incentives, reflecting a collaborative effort to encourage the adoption of renewable energy.

Read more

Tax Benefits on Solar Power in India: A Comprehensive Guide

Feed-in-Tariff (FiT) Policies: FiT policies guarantee a minimum price for solar power, providing a stable revenue stream for project owners. Other Tax Considerations Input Tax Credit (ITC):

Read more

Are Solar Panels Exempt From Property Taxes and

Local tax incentives lessen the overall cost of installing solar panels. Here are the states that provide property tax and sales tax exemptions for solar panels.

Read more

KCCI proposes sales tax exemption to solar panels, inverters

Karachi Chamber of Commerce and Industry (KCCI) has proposed restoration of sales tax exemption on supply of solar panels and inverters.

Read more

Federal Solar Tax Credits for Businesses

To calculate the ITC, you multiply the applicable tax credit percentage by the "tax basis," or the amount spent on eligible property. Eligible property includes the following: Solar PV panels,

Read more

Maximize Solar Savings with State Solar Sales Tax

When you purchase a solar energy system, you typically pay sales tax on the equipment, just like any other purchase. This sales tax can range

Read more

GST on Renewable Energy: India''s Renewable

Input Tax Credit on supply of goods and services related to renewable energy. Manufacturers of Renewable Energy Devices: Businesses that produce

Read more

Solar Tax Exemptions – SEIA

Sales tax incentives typically provide an exemption from the state sales tax (or sales and use tax) for the purchase of a solar energy system. This type of exemption helps to reduce the upfront

Read more

GST rates on solar power based devices and systems

All renewable energy devices, including solar devices or solar power projects, are covered under the ambit of GST. This article throws light

Read more

Budget 2025-26: 18% Tax Imposed on Imported Solar

Aurangzeb stated that the imposition of this tax is a key step towards achieving equality in competition within the solar panel market.

Read more

GST on Supply of Electricity

Electricity supply As per Notification No. 02/2017-Central Tax (Rate) dated 28th June 2017, the supply of electricity is exempt from GST under HSN Code 2716. This means

Read more

Sales tax implications in green energy

Grant Thornton shares perspectives on sales and use tax issues for renewable generation facilities, energy storage and electric vehicle charging stations.

Read more

Local sales tax rates

Local sales tax rates - sales and installations of solar energy systems equipment Local Sales and Use Tax Rates on Sales and Installations of Commercial Solar Energy

Read more

Tax exemptions for home solar power

Solar sales tax exemptions reduce the upfront cost of going solar. If you live in a state with sales tax, you could pay between 2.9% and 9.5% sales tax on the cost of a solar installation. 17

Read more

Tax exemptions for home solar power

Solar sales tax exemptions reduce the upfront cost of going solar. If you live in a state with sales tax, you could pay between 2.9% and 9.5% sales tax on the

Read more

Guide to Sales and Property Tax Exemptions for Solar

As of September 2024, 18 states have sales tax exemptions on buying, and the installation of, new residential and commercial solar power systems. The incentive reduces the

Read more

FBR ends tax exemption on imported solar panels

Instead, imported solar panels will now be subject to a reduced sales tax rate of 10%, effective immediately. The FBR emphasized that this move will promote local industry, encourage

Read more

What is the tax rate for selling solar energy? | NenPower

Tax rates and incentives for selling solar energy substantially differ from state to state. Various jurisdictions have recognized the environmental and economic benefits of solar

Read more

What is the tax rate for selling solar energy? | NenPower

Tax rates and incentives for selling solar energy substantially differ from state to state. Various jurisdictions have recognized the environmental

Read more

FBR Clarifies Sales Tax Exemption on Solar Panels and

However, through the Finance Act 2022, the exemption on sales tax for the import and supply of photovoltaic cells was reinstated, while other accessories and related items of

Read more

What is the new GST rate on solar panels, solar cells and

6 days ago· The GST rate cut is aimed at making renewable energy more affordable and accessible. Providing a huge relief to the renewable energy sector, the 56th GST Council

Read more

Govt may exempt solar equipment from all taxes

Existing tax and tariff structure on import of solar equipment reflects that 17% sales tax is levied on imports of parts/components of solar

Read moreFAQs 6

Do you pay sales tax on solar energy?

Sales tax incentives typically provide an exemption from the state sales tax (or sales and use tax) for the purchase of a solar energy system. This type of exemption helps to reduce the upfront costs of a solar installation. There are 25 states that offer sales tax exemptions for solar energy.

Do you need a sales tax exemption for solar energy?

This type of exemption helps to reduce the upfront costs of a solar installation. There are 25 states that offer sales tax exemptions for solar energy. Arizona, for example, provides a sales tax exemption for the retail sale of solar energy devices and for the installation of solar energy devices by contractors.

Are solar panels tax deductible?

That’s not always the case with solar panels. As of September 2024, 18 states have sales tax exemptions on buying, and the installation of, new residential and commercial solar power systems. The incentive reduces the upfront costs of going solar. The exemption typically applies to all solar equipment, such as batteries.

Do solar panels increase property tax?

Solar panels may increase property tax or cost you hundreds of dollars in sales tax - unless your state offers solar tax exemptions. Here's what's out there.

Which states do not charge sales tax on solar panels?

Five states -- Alaska, Delaware, Montana, New Hampshire and Oregon -- don't charge any sales tax for any purchases. Similar to property tax exemptions, many states will require an application for the sales tax exemption on solar equipment. Which states exempt solar panels from property taxes and sales taxes?

Which states have solar sales tax exemptions?

In all, 34 states plus Puerto Rico and Washington, D.C., have property tax exemptions in effect, but they’re subject to change. For instance, in California, the property tax exemption on solar was recently extended from the end of 2024 to Jan. 1, 2027. What Are Solar Sales Tax Exemptions?